Can you go to jail for disputing charges

Can you go to jail for Disputing prices? Understanding the legal landscape

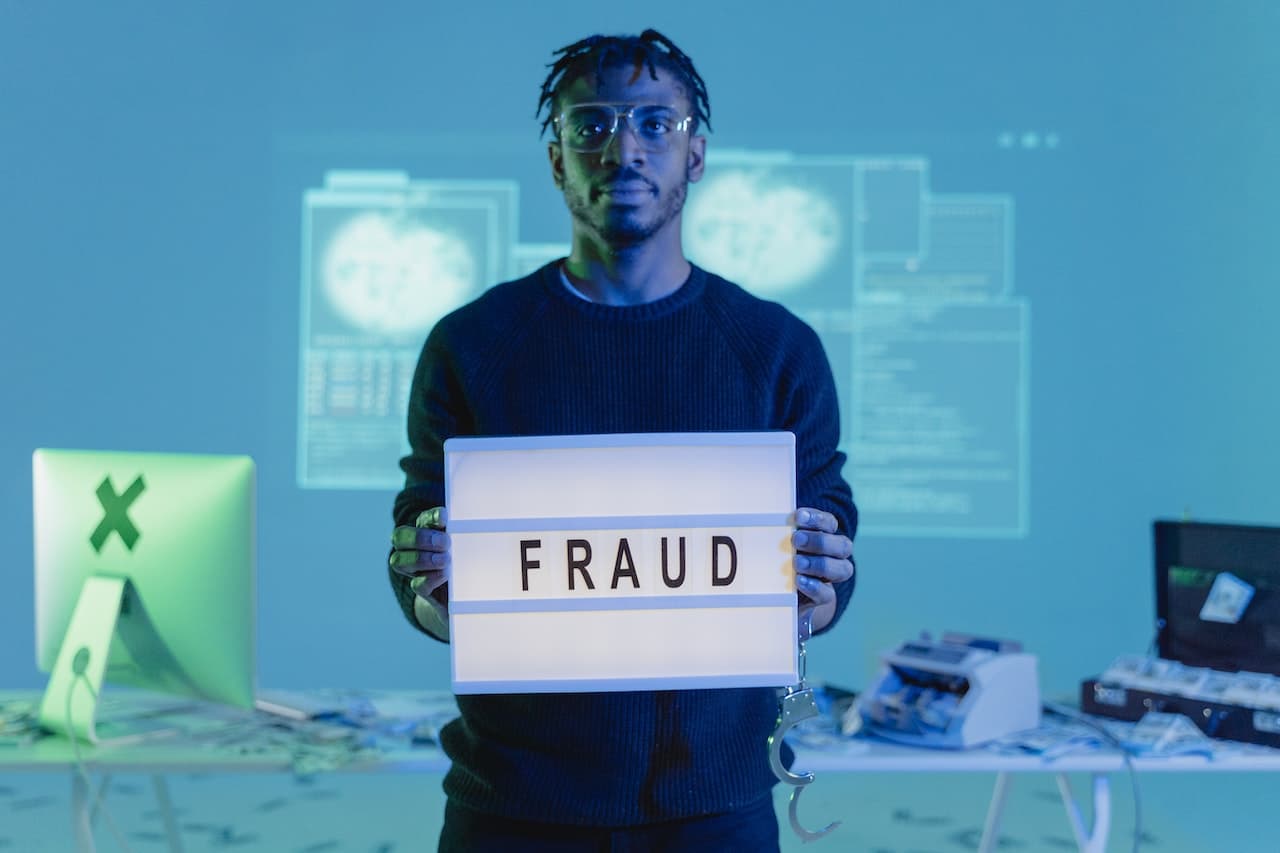

Can you go to jail for Disputing prices : In a modern-day, more and more digital world, wherein transactions are often just a click away, the query of whether or not possible to face prison effects, along with jail time, for disputing prices is greater applicable than ever. This difficulty touches purchasers and traders alike, navigating the high-quality line between protecting one’s financial hobbies and committing fraud. This blog post aims to clarify the distinction between disputing costs as a customer right and the results of fraudulent chargebacks.

Disputing charges vs. Fraudulent Chargebacks

At the heart of economic transactions, particularly in the realm of credit and debit card use, lies the potential of clients to dispute expenses that seem to be on their statements. This mechanism is a crucial client protection tool, permitting people to task unauthorized or incorrect transactions. However, it is vital to distinguish between a legitimate dispute and a fraudulent chargeback.

Valid Disputes

Valid disputes get up while a cardholder does not apprehend a rate on their declaration or while a transaction does now not align with the agreed-upon phrases. Common eventualities consist of:

• Fees for items or offerings by no means received.

• Ordinary charges after canceling a subscription.

• Transactions made with stolen or misplaced credit playing cards.

• Overcharges or billing errors.

In those cases, clients are encouraged to attempt resolution with the service provider immediately. If this method fails or isn’t possible, the following step is to turn to the dispute mechanisms furnished by their bank or card company. Valid disputes are essential rights and deliver no criminal repercussions for the cardholder while pursued in excellent faith.

Fraudulent Chargebacks

Conversely, fraudulent chargebacks occur when a patron knowingly and falsely disputes a charge. Motives would possibly consist of attempting to avoid purchasing received goods or services or disputing transactions for objects they did certainly buy. Such moves constitute fraud and may have excessive prison effects.

Fraudulent chargebacks harm agencies financially and may cause expanded prices for clients. They are investigated via economic institutions and, when determined to be deceitful, can bring about charges of robbery or fraud. Depending on the jurisdiction and the severity of the fraud, people may also face fines, restitution orders, or maybe jail time.

Navigating the Dispute method

For clients, honesty and documentation are the keys to navigating the dispute process. Hold designated facts of your transactions, communicate actually and directly with merchants, and provide thorough documentation throughout the dispute procedure. This approach does not most effectively help your case; however guarantees that the system is utilized for its intended motive of protection, now not exploitation.

For traders, imposing clear transaction descriptions, providing super customer service, and retaining specified facts can assist save you disputes. In cases where disputes arise, enticing cooperatively with the patron and financial institution can help clear up issues successfully and avoid escalating fraudulent chargebacks.

Conclusion

In summary, even as disputing fees is a client properly designed to guard against unauthorized and wrong transactions, it’s critical to approach this technique with integrity. Fraudulent chargebacks are extreme offenses that can result in prison results, which include prison time. Via expertise in distinguishing between legitimate disputes and fraudulent movements, each client and merchant can better navigate the complexities of monetary transactions in the modern digital age.

Recall that the dispute system is there to protect your monetary pursuits, but it ought to be used responsibly and ethically. Keeping off jail time for disputing fees is easy: don’t devote fraud. For folks that stick to this precept, the criminal machine stays a protector, no longer a danger. So, it is vital to be honest and obvious in all economic transactions, keeping believe and integrity of the machine for anybody worried. Keep this in mind while disputing prices, and avoid any fraudulent movements that would have extreme consequences now or in the future. Permit paintings collectively to preserve our economic device, honest and just for all parties involved. So, whether or not you’re a patron or a merchant, expertise in the prison panorama and drawing near disputes with integrity is fundamental to maintaining agreement with and protection against fraud. Keep those concepts in mind as you navigate the sector of economic transactions, and usually, don’t forget: honesty is still the first-class coverage.